Most traders watch price. Some watch order flow. Very few watch the volatility surface in real time.

This project – and the dashboard behind it – is built around one idea:

If you understand how options are priced across strikes and expiries, you have an X-ray of what the market expects – and where it’s most vulnerable.

This first post is a quick tour of the dashboard we’ll be using and a high-level overview of how to think about trading ES/SPX futures through the lens of the vol surface.

I’ll keep it practical, not academic. The goal isn’t to become an options quant; it’s to use the surface to make better, more informed futures decisions.

(Nothing here is trading advice; this is for educational purposes only.)

The Big Picture: How the Dashboard Is Organized

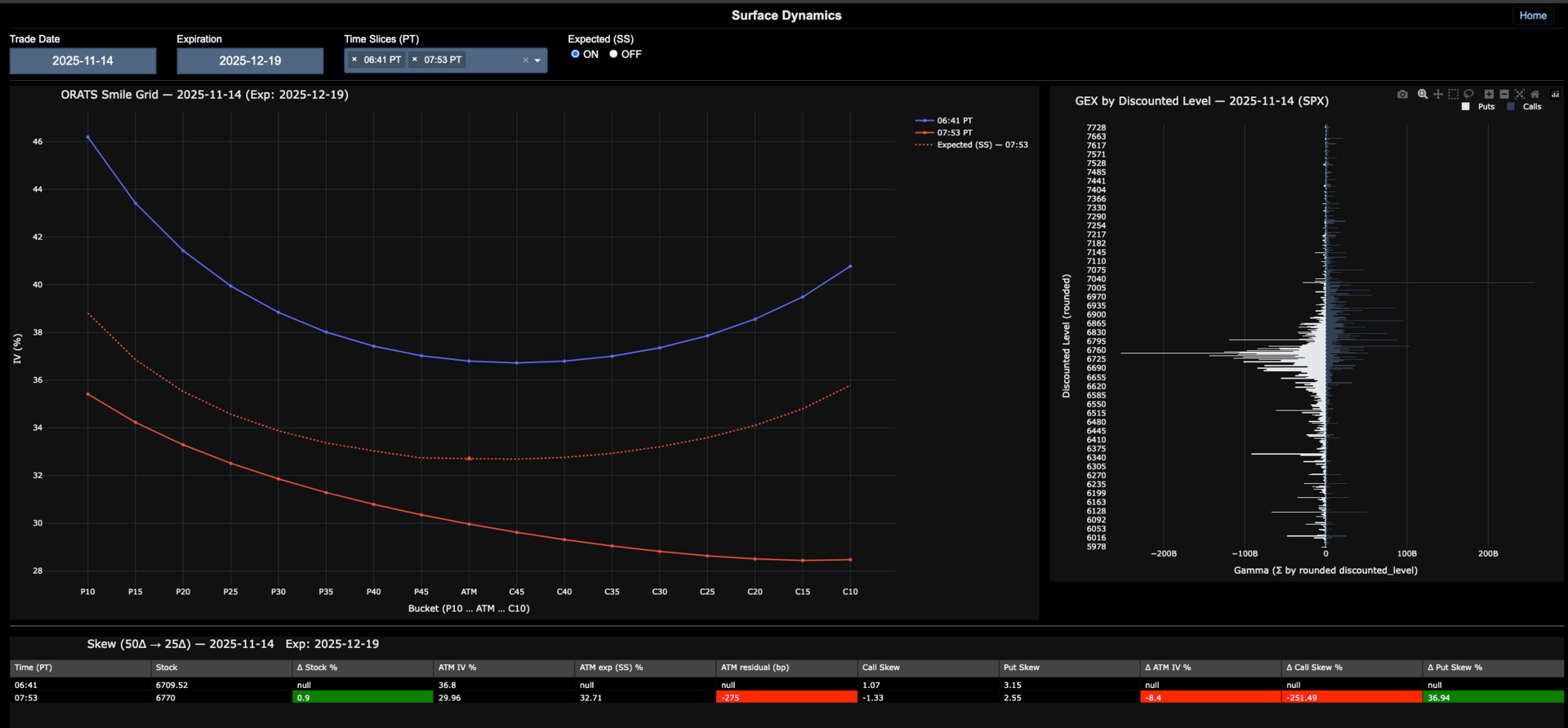

The dashboard is built around SPX options and ES/SPX futures, and updates intraday. Under the hood it’s powered by ORATS data, with additional processing for gamma, skew, curvature, and z-scores.

At a high level, here’s what you’ll see:

Trade Date & Time Controls – Select any trade date and intraday time slice to replay how the surface evolved during the session.

Expiry Selection – Focus on a specific expiration (often 30–60 days out), where the vol surface tends to tell the clearest story for swing and intraday futures trades.

Vol Smile Module (P10 → ATM → C10) – The core of the dash: the implied volatility smile from 10-delta puts through 10-delta calls, adjusted for forward and plotted in “moneyness” space.

Expected vs Actual Curve Overlay – The fitted “expected” smile vs the live “actual” slice, so you can see where the surface is dislocated.

Skew & Curvature Metrics – Numeric summaries of how steep the smile is and how much the wings are kicking up or down.

Wing Behavior (Put/Call Wings) – Focus on how far the put and call wings deviate from “normal” – especially fat put wings after selloffs.

Gamma Exposure (GEX) Chart by Strike – Net dealer gamma plotted across strikes (with the option to separate puts and calls), zoomed into the area around price.

Term Structure & Curve Slope – Volatility across expiries, with slope measures that highlight when the curve is steepening or flattening.

Contextual Stats & Z-Scores – Where today’s skew, curvature, or wing elevation sits relative to its own recent history.

All of this is designed to answer a few practical questions:

Is the vol surface pricing in a move, or reacting to one?

Are dealers positioned in a way that dampens moves (high positive gamma) or amplifies them (deep negative gamma)?

Are options traders panicking in the wings, or is vol staying sticky/contained despite price movement?

From there, we translate that into expectations for ES/SPX: trending, choppy, mean-reverting, or “air-pocket” conditions.

The Vol Smile: Where the Story Starts

The first thing you’ll see on the dash is the volatility smile for a chosen expiry.

What’s Actually Plotted

X-axis: Moneyness – strikes adjusted by forward (so we’re comparing apples to apples even as spot moves).

Y-axis: Implied volatility.

Range: From P10 (10-delta puts) through ATM to C10 (10-delta calls).

Curves:

A smooth “expected” smile (the fitted/monies curve).

The current “actual” timeslice.

We deliberately removed ultra-wing (5-delta) clutter to keep the signal clean from P10 to C10, while still capturing meaningful skew.

How to Read It for Futures

At a high level:

ATM IV vs previous slices

Rising ATM vol with relatively unchanged wings often points to directional uncertainty without outright panic: good for intraday range expansion but not necessarily a crash.

Rising ATM vol and aggressively bid put wing (10-delta) is more of a “hedge panic” / downside stress regime.

Put skew (P10–ATM)

Steep, elevated skew = market paying up for downside.

If price has already sold off and skew is still getting more extreme, the market is often bracing for follow-through or tail risk.

If price has sold off but skew starts to relax (put wing cooling off), that’s often downside exhaustion and a place to look for stabilization or mean reversion in ES.

Call wing (C10–ATM)

Compressed call wing with bid puts = downside-focused market.

Later in the move, if the call wing starts to expand while downside IV relaxes, the surface is quietly shifting toward rebound/rally potential.

Under the hood, the dash also tracks skew and curvature so you can see these behaviors as numbers, not just shapes.

Skew, Curvature & Wing Behavior: Quantifying “Feel”

We all say things like “puts are really bid” or “wings are blown out.” The dashboard turns that intuition into metrics:

Skew – Roughly: how much more expensive are the downside (or upside) strikes vs ATM?

Curvature – How “arched” the smile is vs a straight line between wings and ATM.

Wing Elevation – How far the wings are from their own recent norms.

These are computed across the P10–ATM–C10 region and then compared to their own distribution using z-scores.

That means you can see statements like:

“Put skew is +2.0σ vs the last 60 days.”

“Call wing curvature is at the low end of its range.”

Practically, for ES/SPX futures:

High positive skew z-score + elevated put curvature

→ Market is paying up a lot for downside tails. After a sharp selloff, this often marks a region where additional downside becomes “expensive” unless something new breaks. Short futures gets riskier if the surface stops escalating.Skew normalizing while price is still near lows

→ Hedging pressure may be easing; dealer positioning plus collapsing put IV can create bouncy conditions off key levels.Flat skew + compressed curvature

→ Market isn’t especially worried about either tail. That often aligns with grindy, trend-type environments (especially if gamma is positive), where ES behaves more “technical” and less “air-pocket.”

Gamma Exposure (GEX): Where Dealers Push Back (or Don’t)

On the right side of the dash, you’ll see the Gamma Exposure chart by strike.

What You See

Strikes along the x-axis (in discounted forward space).

Net gamma along the y-axis (often with the option to separate calls and puts).

A vertical line for current spot.

Zoomed automatically to around ±3% of the highest call gamma level, so you’re focused where it matters.

Why It Matters

Dealer gamma acts like a rubber band around certain levels:

Large positive GEX near price

Dealers are long gamma and tend to sell into rallies and buy dips. Futures moves into big positive GEX zones tend to slow down, chop, and mean-revert.Large negative GEX

Dealers are short gamma; their hedging trades with the move. This can amplify trend days and accelerate moves through key strikes.

In practice, we pay attention to:

Big put-heavy GEX zones below price – often where downside moves will tend to decelerate and bounce (especially when the extreme put wing finally collapses).

Upper call-heavy GEX zones – resistance areas where rallies can stall or chop.

One pattern we’ll talk about a lot:

Elevated put wing + large negative put GEX below → sharp selloff → put wing collapses at/near that GEX level → price often bounces.

That’s where ES futures mean-reversion trades frequently line up well with the surface.

Term Structure & Curve Slope: Reading the “Time” Dimension

Another piece of the dash is the term structure: implied vol across expiries.

Key aspects we measure:

Front vs back month vol (e.g., near expiry vs 1–2 months out).

Curve slope across expiries, sometimes summarized between P10–C10 for each tenor.

Patterns:

Steep upward slope (front vol much higher):

Often associated with short-term stress – event risk, recent selloff, or panic hedging. If that stress doesn’t resolve with realized volatility, the front can come in sharply (vol crush), which usually supports ES higher or at least stabilizing.Flattening curve after a big move:

When the curve flattens and stays flatter while price grinds, it often signals that the market has “absorbed” the shock and is transitioning toward more range-bound or mean-reverting behavior. Those are environments where intraday ES pullbacks off extremes become more attractive.Inverted or unusually flat term structures:

Can flag regime shifts – moments when the market is pricing similar risk in the front as in the back, or even more in the back. These are less common and worth paying attention to as early warnings.

As with the smile itself, the dash compares these slopes vs their recent history so you’re not just eyeballing shapes – you know when the curve is truly unusual.

Intraday Surface Dynamics: Comparing Time Slices

Futures traders live intraday, so the dash is built to let you replay the day.

You can:

Choose a trade date.

Select different time slices (e.g., 9:30, 10:15, 11:00…).

See how:

ATM IV,

Skew & curvature,

GEX profile (as OI rolls),

And wing behavior

evolved as the session unfolded.

This is powerful for:

Understanding what “real” stress looks like in vol compared to routine noise.

Building a playbook of surface patterns that preceded specific types of ES days:

Gap down + elevated put skew + deeply negative GEX → trend-down or flush days.

Gap down + skew peaks early, then relaxes while GEX stabilizes → flush-then-bounce days.

Flat vol, modest skew, strong positive GEX → slow grind, breakout fade type days.

Over time, you can tag days and build your own mental (or literal) library of “vol regimes” and how ES responded.

Translating the Surface into Futures Frameworks

Here’s the key point:

The dashboard is not a signal generator. It’s a context engine.

You still need your own entries, stops, and risk management. But the vol surface helps answer:

Should I be pressing momentum or fading extremes?

Is this a regime where size should be bigger or smaller?

Is downside/upside expensive or cheap relative to what we’ve seen recently?

A few high-level frameworks we’ll use going forward:

1. “Panic vs Exhaustion” on Down Moves

Panic regime

Sharp ES selloff

ATM IV jumping

Put wing and skew screaming higher (high skew/curvature z-scores)

Negative put-heavy GEX building but not yet “spent”

→ Market is in active stress. Trend trades / momentum are more interesting if GEX and skew keep confirming.

Exhaustion regime

ES makes new or marginal lows

Put skew and curvature stop making new highs or start to relax

Put wing IV comes down even as price tests/pierces lows

Price approaches a big put GEX level

→ Conditions are shifting toward bounce / mean reversion. Even if price prints marginal new lows, there’s often less “fuel” behind them.

2. “Complacent Trend” vs “Trapped Range”

Complacent trend

Vol is relatively low and stable

Skew and curvature near their historical means

Positive GEX dominates around price

→ ES tends to grind, with breakouts more likely to stick if they align with broader flows, but realized vol is lower. You don’t necessarily want to fade every breakout blindly here; instead, you expect controlled moves.

Trapped range

Vol not extreme, but GEX builds strong levels both above and below

Surface not pricing big tails either way

→ ES often oscillates between gamma “walls.” Swing futures trades may be less attractive; intraday mean-reversion around those levels can be more effective.

3. “Surface vs Surface” – Has Anything Really Changed?

Because the dash lets you compare timeslices (or even days) with the same moneyness mapping, you can ask:

Is the surface actually different from earlier, or did price just move?

If price moves to the strike where the previous smile already implied higher IV (e.g., ATM moves from 6000 to 5970 and IV is exactly where the initial smile predicted), then the move may be more “mechanical” and less informative.

If, instead, IV is much higher or lower than the previous smile predicted at that same moneyness, that’s a real surface shift – something meaningful has changed in how the market is pricing risk.

Over time, we’ll explore how to use that idea to filter for high-quality futures trades.

What to Expect From This Site

This first post is just the orientation.

Going forward, I’ll use the dashboard to:

Walk through specific trading days, showing:

The price action in ES/SPX,

How the vol surface and GEX evolved,

What patterns showed up before big moves, failed breakouts, and sharp reversals.

Build a playbook of repeatable setups based on the surface:

Elevated put wing into big GEX levels,

Curve flattening and pullbacks,

Vol crush following over-priced event risk,

Regimes defined by skew/curvature z-scores.

Share ideas on how to structure trades (both futures and options spreads) that align with what the surface is telling us, without turning this into a signal service.

If you’re interested in:

Seeing the why behind the moves, not just the candles,

Using options data to improve your futures trading,

And building a rules-based view of volatility regimes,

then you’re in the right place.

Thanks for checking out the first post and the initial version of the dashboard.

In the next pieces, we’ll dig into concrete examples – real days, real surfaces, and how you might have approached trading ES with that information in front of you. If you want to follow along as I break down real trading days using this dashboard, subscribe so you don’t miss the next post.