At A Glance

Bias: Looking to fade strength into a GEX-defined reaction band, not chase upside.

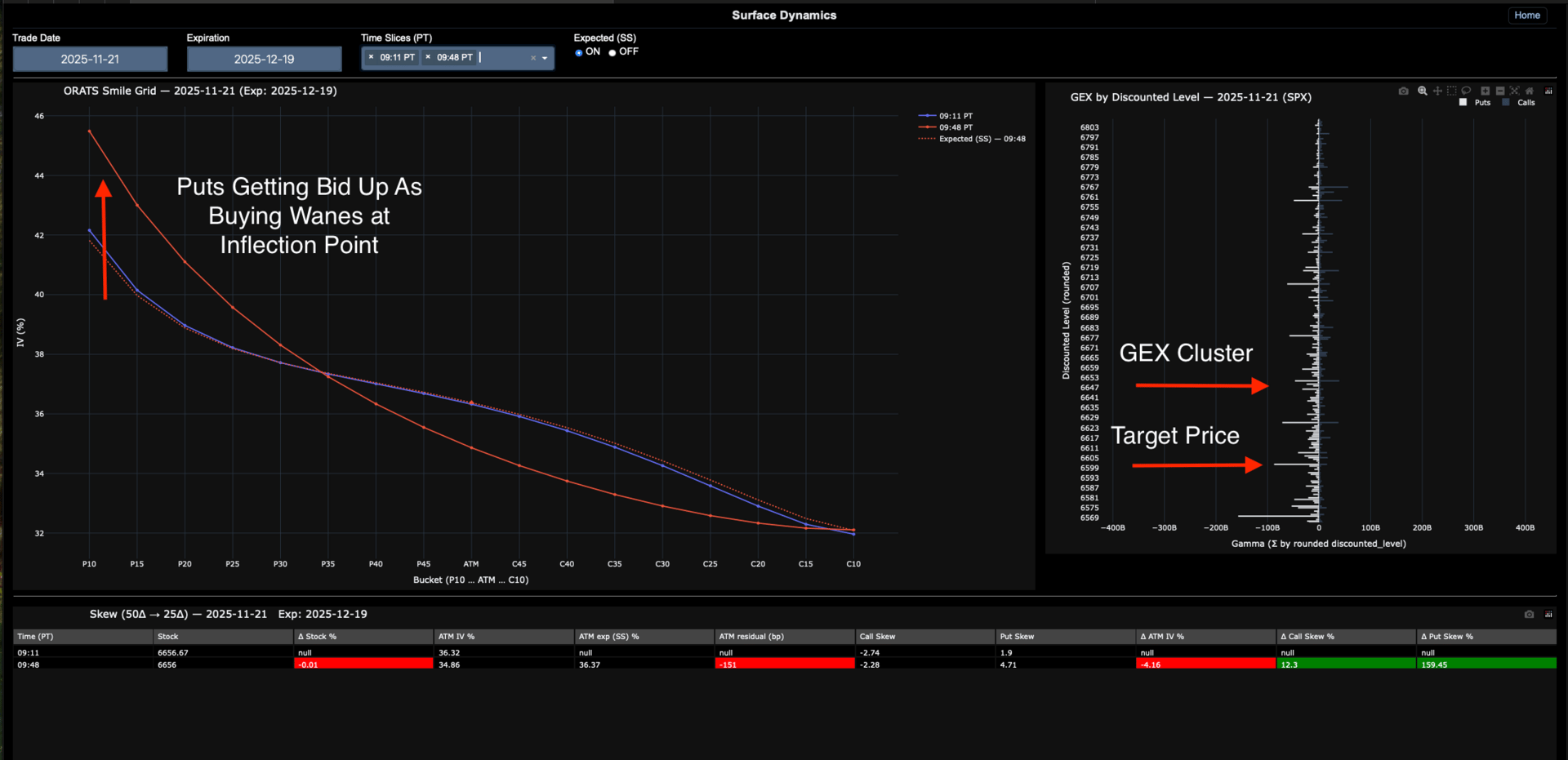

Vol regime: ATM IV a bit softer than expected; downside puts repriced sharply higher.

Key ES levels: 6601 & 6646-51

Primary plan:

Use the GEX band to define “where” to care.

Wait for buyer exhaustion (CVD) and a shift toward downside protection (smile) before leaning short.

Market Context

The morning ES session pushed higher off the prior day’s lows and worked its way into a pre-defined GEX reaction band in the mid-6600s. That band was built from large stacked put positions above and below spot on Surface Dynamics — not a hard “ceiling,” but an area where dealer hedging flows and market reactions tend to cluster.

Coming into the day, my plan was simple:

Let price trade into that GEX band.

Only look for shorts if:

Buyers started to show signs of exhaustion in the tape/CVD, and

The options surface began to lean more heavily toward downside protection.

GEX bands give me the where. The smile and realized flow tell me when (or if) to get involved.

Dealer Positioning & GEX

On Surface Dynamics, the mid-6600s stood out as a GEX-defined reaction zone built from large put positions clustered both above and below spot. In practice, I treat this kind of region as:

A map level where hedging flows are concentrated.

A place where the market is more likely to react, pause, or mean-revert.

Not guaranteed resistance, but a local inflection zone where I want to pay extra attention.

My framework is:

If price drifts into a GEX band with strong, healthy buying behind it, I’m cautious about fading.

If price presses into a GEX band while flows and the surface start to shift, I’m more open to fading back toward the next put-heavy cluster.

On this day, ES pushed into the upper edge of that band in @6646-51, setting the stage but not yet triggering a trade by itself.

Vol Surface & Skew

The key confirmation came from how the Dec 19 smile evolved as ES traded into the band.

On Surface Dynamics, I compared the 09:11 PT smile to the 09:48 PT smile for the same expiry:

ATM IV actually dropped ~150 bps versus a simple sticky-strike expectation.

Put skew moved sharply higher – from roughly 1.9 → 4.7 (on the order of a 160% increase).

Call skew barely changed.

Put differently, for this expiry:

The market was selling ATM volatility relative to what a sticky-strike move alone would imply.

At the same time, it was bidding up downside puts relative to ATM.

The left tail was being repriced higher relative to the center of the distribution, while calls stayed quiet.

That doesn’t tell us exactly who did what (customers, dealers, RV funds, etc.), but it is consistent with:

Supply at the center (ATM vol for sale).

Demand for downside protection (put wing getting more expensive vs ATM).

That’s the type of surface change I want to see when price is already pressing into a GEX reaction zone: the distribution of outcomes is being skewed more heavily toward the downside, even without a big price break on the screen.

Trade Plan

Price + CVD: buyers start to run out of gas

On the 1-minute chart, as ES climbed into the upper edge of the GEX band:

Price continued to grind higher.

Cumulative Volume Delta (CVD) started to flatten and then roll over.

The CVD rectangle on the chart shows a classic buyer-exhaustion pattern: higher prices, but net aggressive buying no longer expanding in step with the move.

At that point, I had:

Location: trading into a well-defined GEX reaction band.

Flow: buyers no longer pressing their advantage the way they had earlier.

Surface (shortly after): ATM IV sold relative to expectation, put skew notably higher, calls flat.

Individually, none of those is a guarantee. Together, they start to tilt the odds enough (for me) to get involved — as long as I’m willing to be wrong quickly.

Primary Scenario – Fading into the band

Once those three pieces lined up in the mid-6600s, my primary plan was:

Entry idea: Work into shorts inside the upper part of the GEX band, as buyer exhaustion + a more downside-heavy smile developed.

Risk:

Use the top of the band / recent high as a reference for risk.

If buyers re-engage (CVD re-expands) or the smile normalizes, respect that and get out.

Target:

A rotation back toward the lower put GEX cluster around 6601, not an attempt to call a crash.

In practical terms:

Fade strength into the band.

Cover into the next big put GEX cluster.

Reassess rather than assume follow-through.

Alternate Scenario – No exhaustion, no trade

An equally important part of the framework:

If CVD had stayed strong (no exhaustion),

Or if the smile hadn’t shifted toward downside protection (no skew jump, no ATM residual),

Or if price had accepted cleanly above the GEX band,

…then this would simply have been “no trade” for me. The process matters more than forcing a narrative every time price touches a level.

Patience here is the real edge: I don’t need to nail the high tick; I need the conditions that justify taking asymmetrical risk.

Trade Review

What happened

After building into shorts in the mid-6600s:

ES rotated lower off the GEX band.

Price moved back toward the lower put GEX area near 6601.

There was no dramatic collapse – just a clean rotation off an inflection zone back into a GEX magnet.

That’s exactly the type of outcome this framework is designed for: not home runs, but repeated, local asymmetric trades.

What worked

Defining the GEX band ahead of time gave me a clear “map” of where I cared to trade.

Watching CVD into the band kept me from chasing the late-stage push higher.

Using the smile change (ATM residual + put skew) as a confirmation helped distinguish:

“Just another test of resistance”

from“The market is actively repricing downside risk at this location.”

What this setup is — and isn’t

This sequence is not a slam dunk pattern:

CVD can “fake out” and buyers sometimes re-engage.

Skew can pop while price still grinds higher as hedges get monetized.

One expiry (Dec 19 here) is just one slice of the overall term structure.

What I care about is process:

Define important GEX locations ahead of time.

Watch realized flow (CVD / tape) as we approach them.

Confirm with changes in the smile – especially:

ATM IV vs a simple expectation, and

Put skew behavior relative to calls.

When those three line up, I’m more willing to put risk on. When they don’t, I’m happy to let the market move without me, even if it means missing some trades.

This write-up is one example of that process, not a claim that every similar pattern will behave the same way. The next step is collecting more samples and, eventually, stats.